| PDF Title | Revised Guidelines on Purchase, Use & Entitlement of Staff Cars in CPSEs 2025 |

| Category | |

| Order no | No. 2(23)/11-DPE (WC)/FTS-1128 |

| Order Date | Sep 15, 2025 |

| Total Pages | 2 |

| Posted By | Admin |

| Posted On | Sep 17, 2025 |

| Source | Ministry of Finance |

Get PDF in One step

| PDF Title | Revised Guidelines on Purchase, Use & Entitlement of Staff Cars in CPSEs 2025 |

| Category | |

| Order no | No. 2(23)/11-DPE (WC)/FTS-1128 |

| Order Date | Sep 15, 2025 |

| Total Pages | 2 |

| Posted By | Admin |

| Posted On | Sep 17, 2025 |

| Source | Ministry of Finance |

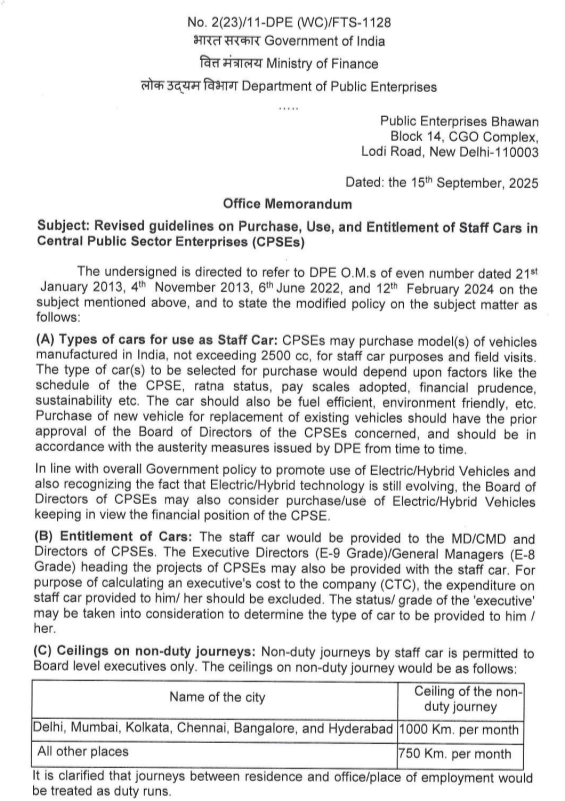

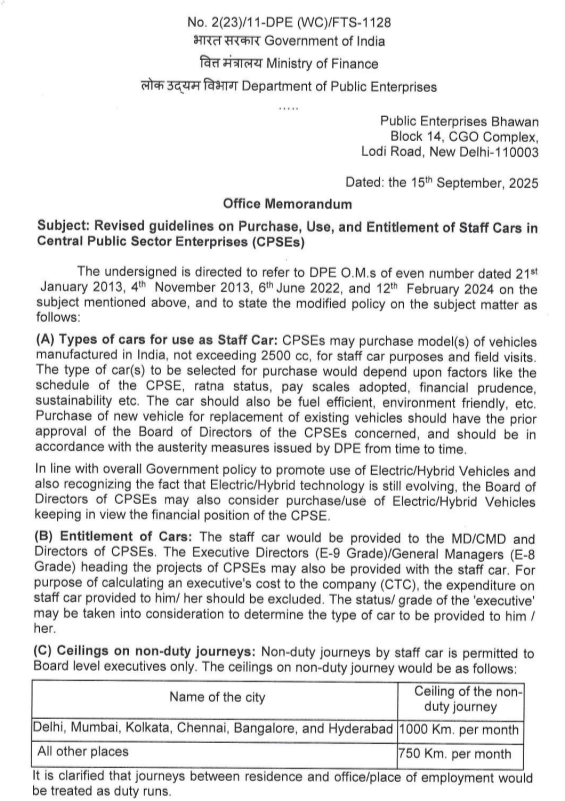

No. 2(23)/11-DPE (WC)/FTS-1128

Government of India

Ministry of Finance

Department of Public Enterprises

Public Enterprises Bhawan

Block 14, CGO Complex,

Lodi Road, New Delhi-110003

Dated: the 15th September, 2025

Office Memorandum

Subject: Revised guidelines on Purchase, Use, and Entitlement of Staff Cars in Central Public Sector Enterprises (CPSEs)

The undersigned is directed to refer to DPE O.M.s of even number dated 21st January 2013, 4th November 2013, 6th June 2022, and 12th February 2024 on the subject mentioned above, and to state the modified policy on the subject matter as follows:

(A) Types of cars for use as Staff Car: CPSEs may purchase model(s) of vehicles manufactured in India, not exceeding 2500 cc, for staff car purposes and field visits. The type of car(s) to be selected for purchase would depend upon factors like the schedule of the CPSE, ratna status, pay scales adopted, financial prudence, sustainability etc. The car should also be fuel efficient, environment friendly, etc. Purchase of new vehicle for replacement of existing vehicles should have the prior approval of the Board of Directors of the CPSEs concerned, and should be in accordance with the austerity measures issued by DPE from time to time.

In line with overall Government policy to promote use of Electric/Hybrid Vehicles and also recognizing the fact that Electric/Hybrid technology is still evolving, the Board of Directors of CPSEs may also consider purchase/use of Electric/Hybrid Vehicles keeping in view the financial position of the CPSE.

(B) Entitlement of Cars: The staff car would be provided to the MD/CMD and Directors of CPSEs. The Executive Directors (E-9 Grade)/General Managers (E-8 Grade) heading the projects of CPSEs may also be provided with the staff car. For purpose of calculating an executive’s cost to the company (CTC), the expenditure on staff car provided to him/ her should be excluded. The status/ grade of the ‘executive may be taken into consideration to determine the type of car to be provided to him / her.

(C) Ceilings on non-duty journeys: Non-duty journeys by staff car is permitted to Board level executives only. The ceilings on non-duty journey would be as follows:

| Name of the city | Ceiling of the Non-duty journey |

| Delhi, Mumbai, Kolkata, Chennai, Bangalore, and Hyderabad | 1000 Km. per month |

| All other places | 750 Km. per month |

It is clarified that journeys between residence and office/place of employment would be treated as duty runs.

(D) Recovery for the private use/non-duty runs of the Staff car: The recovery amount for private use/non-duty runs would be Rs.2000/-per month.

(E) Use of Staff Car during leave of absence: The facility of exclusive use of the staff car to the entitled executives could also be availed of during the period of leave not exceeding two months provided that period is spent at the headquarters. The members of the family of the concerned executive who remains absent from his/her headquarters continuously for a period of fortnight could also avail of the facility of the staff car allotted to the concerned executive subject to his/her agreeing to pay the rates specified for private use as also the cost of propulsion.

(F) Facility of Staff Car for private use/non-duty runs at places other than headquarters: Private use of the staff car allotted to the entitled executive should normally be restricted to the limits of the headquarters town where the concerned executive has been stationed. If an executive takes a staff car out of headquarters while on temporary duty to another station, he/she could be permitted the private use of the staff car within the overall ceilings for private use/non-duty runs referred to above.

(G) Payment of conveyance re-reimbursement or conveyance allowance at the approved rates to executives other than key officials may be restricted to official duty only.

2. All the administrative Ministries/Departments of the Government of India are requested to bring the foregoing to the notice of the CPSEs under their administrative control for necessary action.

3. This issues with the approval of the Secretary, Department of Public Enterprises.

Sd/-

(Dr. P.K. Sinha)

Deputy Secretary to the Government of India