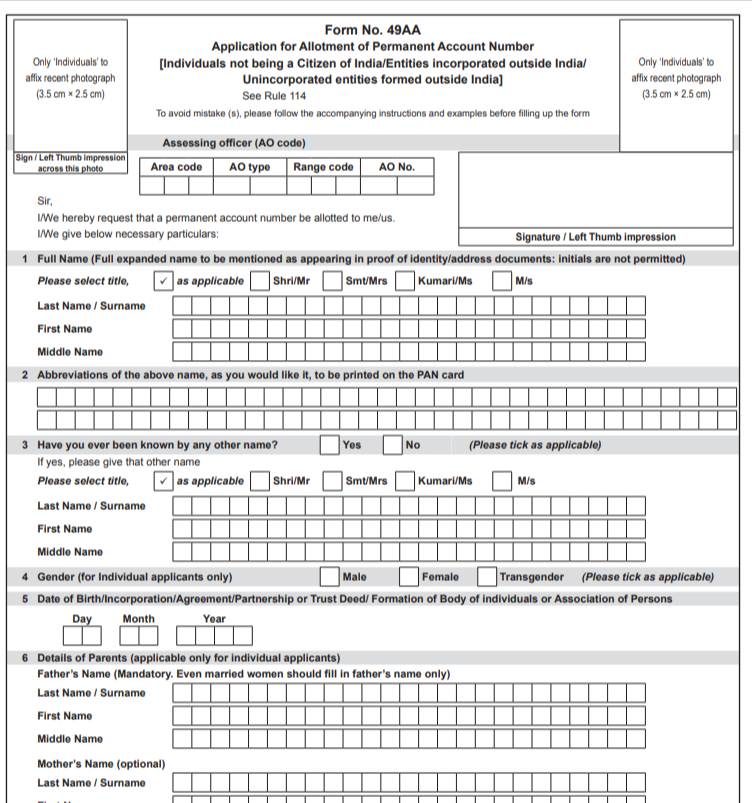

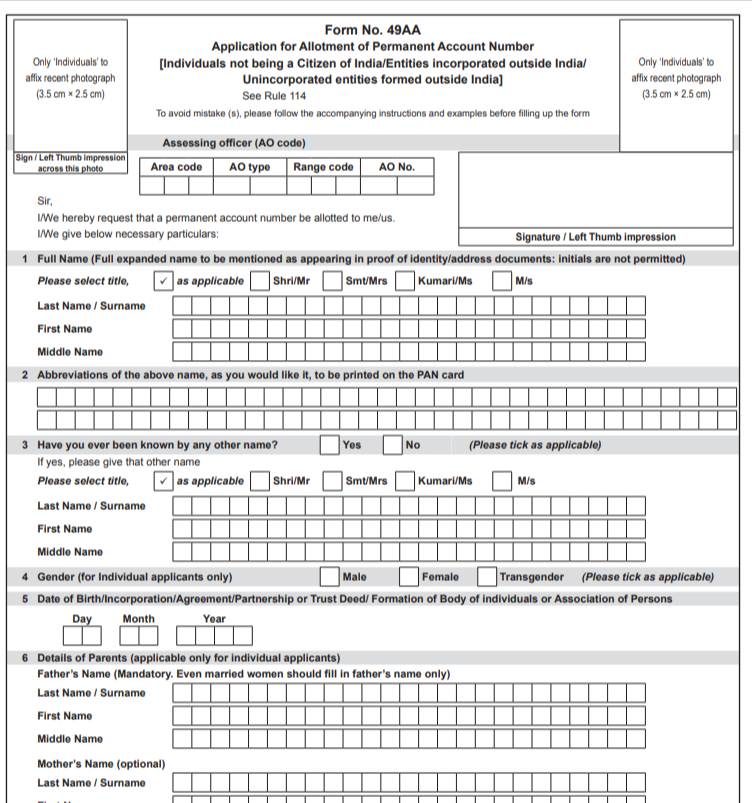

| PDF Title | Pan Card Form 49AA for foreign citizens |

| Category | |

| Total Pages | 4 |

| Posted By | Admin |

| Posted On | Aug 02, 2025 |

Get PDF in One step

| PDF Title | Pan Card Form 49AA for foreign citizens |

| Category | |

| Total Pages | 4 |

| Posted By | Admin |

| Posted On | Aug 02, 2025 |

Form 49AA is used by foreign citizens or foreign entities (non-residents, foreign companies, or organizations) to apply for a Permanent Account Number (PAN) in India. It is governed by Rule 114 of the Income Tax Rules, 1962, and is mandatory for foreign investors or entities conducting financial transactions in India.

| Feature | Form 49A | Form 49AA |

| Purpose | Application for PAN | Application for PAN |

| Who Uses It | Indian Citizens, entities incorporated or registered in India | Foreign Citizens, foreign entities or organizations |

| Applicable For | Individuals, HUFs, Companies, Firms, Trusts, AOPs, BOIs, etc. residing or incorporated in India | Individuals, Companies, Firms, Trusts, etc. not based in India |

| Issued By | Income Tax Department of India | Income Tax Department of India |

| Governing Rule | Section 139A of the Income Tax Act | Section 139A of the Income Tax Act |

| Identity Proof Required | Aadhaar card, Voter ID, Passport, Driving License, etc. | Passport, PIO/OCI card, bank statements, etc. (attested) |

| Address Proof Required | Indian address documents | Foreign address documents or Indian local address (if any) |

| Signature/Photograph Requirement | Yes | Yes |

| Mode of Submission | Online via NSDL or UTIITSL, or Offline | Online via NSDL/UTIITSL, or through authorized entities (Embassy, etc.) |

1. Proof of Identity (any one):

2. Proof of Address (any one):

All documents must be attested by:

For Foreign Entities (companies, firms, trusts, etc.):

1. Proof of Identity (any one):

2. Proof of Address (any one):

Additional Requirements:

Submit and download acknowledgment (You’ll get a 15-digit acknowledgment number)

Send documents (if required) to

NSDL e-Gov 5th Floor, Mantri Sterling Model Colony, Pune – 411016, India